Platinum Group Metals PGM Refining, including platinum (Pt), palladium (Pd),

rhodium (Rh), ruthenium (Ru), iridium (Ir), and osmium (Os), hold immense industrial

value due to their critical roles in catalysis, electronics, and advanced manufacturing.

However, with global PGM reserves dwindling and mining costs escalating, recycling now

accounts for 42% of annual PGM supply. To address this paradigm shift, modern recovery

technologies have evolved to maximize efficiency and sustainability.

Foremost among PGM sources, automotive catalysts dominate the recycling stream,

contributing 55% of recovered PGMs. These components typically contain 50–60% Pt, 30–40% Pd,

and 5–10% Rh, with recovery yields reaching 95–98% through advanced hydrometallurgical

processes. Equally significant, electronic waste emerges as a key secondary source, where

circuit boards and connectors harbor 200–800 ppm PGMs—a concentration 40–80 times

higher than primary ores. Meanwhile, industrial catalysts from petrochemical and nitric acid

production add another 15% to the recovery pool, often containing Pt/Rh or Pd/Ru combinations.

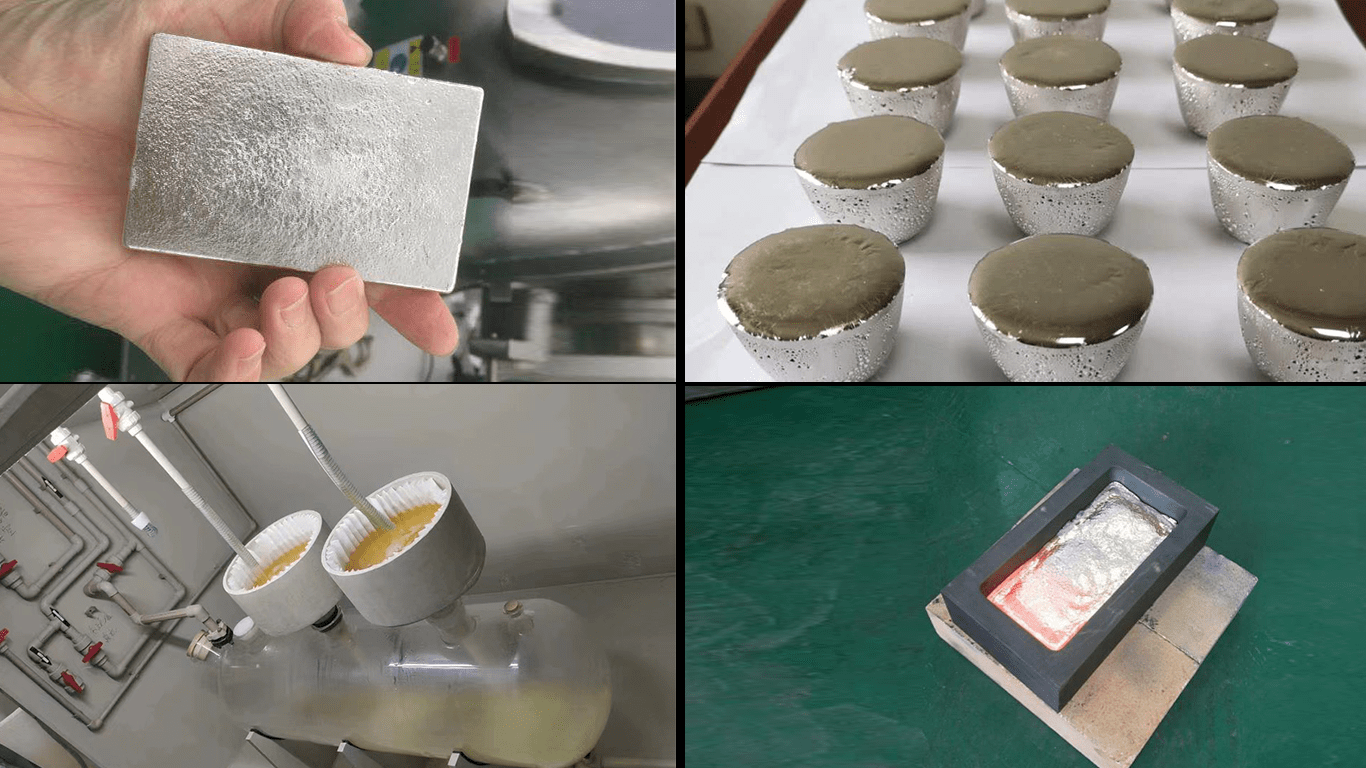

Transitioning to recovery methodologies, physical pretreatment forms the critical first step.

Operators mechanically crush automotive catalysts and e-waste into sub-millimeter particles,

thereby increasing subsequent leaching efficiency by 40%. Following size reduction, magnetic and

eddy current separators remove 85–95% of iron, copper, and aluminum impurities. Subsequently,

rotary kiln roasting at 800–1,200°C eliminates organic residues while oxidizing base metals for

easier separation.

When considering chemical extraction, hydrometallurgy remains the workhorse for 80% of

operations. For instance, aqua regia leaching recovers 95–98% of Pt and Pd from electronic waste,

whereas HCl-Cl₂ mixtures prove more effective for Ru and Ir isolation. After dissolution, selective

precipitation techniques come into play: ammonium chloride isolates platinum as (NH₄)₂[PtCl₆]

at pH 1.5–2.0, while stannous chloride reduces palladium to 99.95% pure sponge. Conversely,

pyrometallurgical methods dominate high-grade feedstock processing, where induction furnaces

melt materials at 1,600–1,800°C with borax flux, producing PGM-rich matte for further refinement.

Regarding purification, electrolytic refining elevates metal purity to 99.99% for critical applications.

Specifically, titanium cathode meshes immersed in HCl-based electrolytes recover PGMs at 200–500 A/m²

current densities, consuming 8–12 kWh per kilogram. Notably, this stage often integrates with IoT

monitoring systems to optimize voltage and temperature parameters in real time.

From an economic perspective, PGM recycling demonstrates compelling advantages. To illustrate,

hydrometallurgical plants achieve ROI within 18–24 months, processing automotive catalysts into metals

valued at 3,800–5,200/kg. Furthermore, sustainability metrics reveal a 78% reduction in carbon footprint

compared to mining—4.2 kg vs. 18.5 kg CO₂ per kilogram PGMs. Looking ahead, innovations like AI-driven

material sorting and ionic liquid solvents promise to boost recovery rates while slashing acid consumption

by 60%, positioning urban mining as a 55% PGM supplier by 2030.

In summary, the convergence of optimized physical pretreatment, advanced chemical extraction, and

smart purification technologies has transformed PGM recycling into a high-yield, environmentally strategic

industry. As resource scarcity intensifies, these methodologies will increasingly underpin global PGM supply

chains while driving circular economy objectives.

Platinum Group Metals (PGM) Refining.vido

Call us now: